As the air grows crisper, and the evenings become shorter, the impending arrival of fall is on everyone’s mind. For me, as a redhead, fall is undoubtedly my favorite season. I eagerly await the opportunity to don sweater dresses, light pumpkin spice candles, and embrace cozy nights on the couch with a captivating book. It’s the season for planning autumn-themed activities with friends and savoring the simple pleasures.

However, after a summer of enthusiastic spending and saying “yes” to every exciting opportunity (which isn’t a bad thing!), I realize it’s time to rein in my spending habits as we transition into fall. The ambitious financial goals I set for myself at the beginning of the year faded into the background during the summer fun. Now, I’m determined to make changes and get back on track, ensuring I accomplish these goals by year-end, or at least make significant progress. Before my favorite season officially kicks off, here’s how I’m revitalizing my finances to finish the year strongly.

Budget for Fall Activities:

During the summer, I tend to adopt a “spend without thinking” mindset, embracing impromptu activities and experiences. While this is enjoyable, it often derails my budget. This fall, I aim to adopt a more intentional approach to balance experiences with prudent spending. I’ll set aside money each week for my inevitable fall Starbucks indulgence (a necessity once the chill sets in), plan lower-cost activities like apple picking and baking with friends, and choose cozy cooking nights over restaurant patio dinners. These deliberate swaps allow me to save money while still savoring the essence of fall.

Review and Adjust Savings Goals:

Like many, I started the year with ambitious financial resolutions – saving for a future home, investing a specific percentage of my income, and consulting a financial advisor. However, as the year progressed, some of these goals veered off course or slipped my mind entirely. In September, I plan to evaluate my progress and outline achievable next steps. If I’ve strayed from my original goals, I won’t stress; instead, I’ll revise them to remain motivating yet realistic. For instance, if saving $500 a month for a down payment derailed during the summer, I’ll resume in the next month, inching closer to my dream, one step at a time.

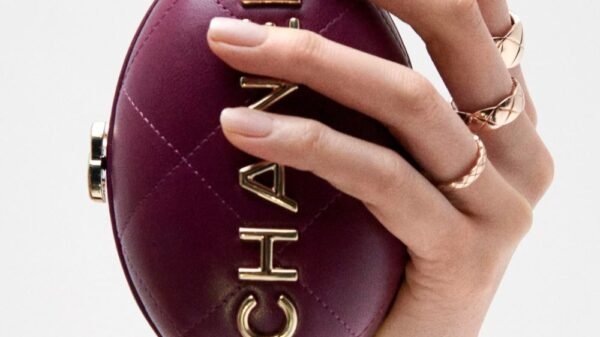

Spend Mindfully on Fall Items:

My love for fall often translates into shopping for cute decor, coordinating Halloween costumes with my dog (our Legally Blonde-inspired costumes are a highlight this year), and investing in cozy sweaters. This year, I aim to balance my enthusiasm by making mindful spending choices. I’ll focus on quality, long-lasting items instead of trendy novelties or homeware that won’t withstand a year’s use. A timeless trench coat and sturdy riding boots top my shopping list, and I’ll resist the allure of everything else with a fall theme. If you’re in the same boat, take a moment to decide what’s truly worth spending on this season to avoid impulsive purchases.

Review Your Investments:

As September brings back-to-school vibes, it’s an ideal time to immerse yourself in financial housekeeping. Set the mood with a gourmet hot chocolate and background Harry Potter, then delve into your investments. Review the progress and make necessary adjustments, such as enrolling in your employer’s 401K matching or refining your portfolio’s risk tolerance. I also check the fees I’ve paid during the year to ensure they align with my financial goals. This financial admin session takes on a cozy, enjoyable vibe in the fall, almost like a date with my future self.

Check on Debt and Create a Repayment Plan:

Fall is an opportune time to revisit debt repayment strategies. If you have high-interest credit card debt, consider devising a plan to tackle it, whether by adding a small extra payment each month or aiming to clear one card before the year-end. For those with student loans or other debts, explore consolidation or payment optimization options, even slight increments can significantly reduce the total interest paid. Fall’s limited timeframe inspires a sense of urgency, making it easier to commit to a plan and accomplish financial goals before the new year.

Start Saving for the Holidays:

While the holidays may seem distant, they’ll arrive sooner than we think, bringing gift purchases, party hosting, and family visits. All these activities can strain your budget. Early fall is an excellent time to assess expected holiday expenses and create a financial plan. By setting aside funds gradually, you can prepare more comfortably. For example, if you anticipate spending around $1000, allocating $250 a month now is more manageable than facing the full cost in December. I prefer to place this money in a separate account or use budgeting methods like the envelope system. Don’t forget to utilize any credit card points, loyalty programs, or cashback to offset your holiday expenses.

Prepare to Ask for a Raise:

Many companies conduct end-of-year performance reviews. It’s wise to strategize now to maximize your compensation during these reviews. If you plan to request a raise or promotion, ensure you’re on track to meet your role’s expectations. Take this opportunity to benchmark industry salaries, gather positive feedback and results from the year, and initiate discussions with your manager. Preparing in advance can boost your confidence and help you achieve a more substantial raise.

Embrace the serene, rich vibes of fall to navigate your financial journey and manifest your goals. Use the season’s quieter moments to plan, budget, and pave the way for a successful end to the year.